High-Nickel Binders Market is Anticipated to Reach USD 3,267.0 Million by 2036 on Rising EV Battery Demand | FMI Reports

Germany’s high-nickel binders market is set to grow at an 11.1% CAGR, driven by EV batteries, advanced chemical expertise and tight auto–supplier collaboration.

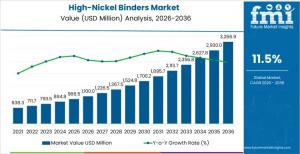

NEWARK, DE, UNITED STATES, January 19, 2026 /EINPresswire.com/ -- The global high-nickel binders market is emerging as a critical enabler within the lithium-ion battery value chain, as battery manufacturers worldwide accelerate adoption of nickel-rich cathode chemistries to meet electric vehicle (EV) performance, cost, and sustainability targets. According to the latest market outlook, the sector is projected to expand from USD 1,100.0 million in 2026 to USD 3,267.0 million by 2036, registering a compound annual growth rate (CAGR) of 11.5% over the forecast period.

This growth reflects structural changes underway in battery design, where high-nickel cathodes—notably NMC 8xx and above—are increasingly favored for their ability to deliver energy densities approaching 250 Wh/kg while reducing reliance on cobalt. However, these cathodes introduce aggressive chemical and mechanical conditions that conventional electrode binders cannot reliably withstand, elevating the strategic importance of advanced binder systems.

Discover Growth Opportunities in the Market – Get Your Sample Report Now

https://www.futuremarketinsights.com/reports/sample/rep-gb-31547

Market Context: Why High-Nickel Binders Matter Now

High-nickel binders are specialized polymer formulations engineered to maintain electrode integrity in nickel-rich cathodes that undergo particle cracking, phase transitions, and surface reconstruction during repeated charge–discharge cycles. Without suitable binders, battery cells face accelerated capacity fade, safety risks, and manufacturing yield losses.

As global automakers and battery manufacturers invest billions of dollars in next-generation EV platforms, binder performance has become a determining factor in whether high-nickel cathodes can transition from laboratory innovation to large-scale commercial deployment. The rapid expansion of the high-nickel binders market reflects the industry’s progress in overcoming these challenges through material science and process optimization.

Quick Stats: High-Nickel Binders Market Snapshot

• Market value (2026): USD 1,100.0 million

• Forecast value (2036): USD 3,267.0 million

• Forecast CAGR (2026–2036): 11.5%

• Leading binder chemistry: PVDF-based (38%)

• Leading customer segment: Cell OEMs (62%)

• Key growth countries: China, United States, United Kingdom, Germany, Japan

Technology Landscape: How the Market Is Structured

The high-nickel binders market is segmented across binder chemistry, cathode type, solvent system, and customer category, reflecting the complexity of matching binder performance to evolving cathode architectures and manufacturing requirements.

Key structural insights include:

• Binder chemistry: PVDF-based binders hold the largest share at 38%, supported by modified formulations that enhance chemical resistance and mechanical flexibility while preserving established manufacturing compatibility.

• Cathode type: NMC 8xx and above cathodes account for 52% of demand, driven by aggressive nickel content levels that require advanced binder solutions to stabilize cycling performance and safety.

• Solvent system: NMP-based processing dominates with 56% market share, due to superior polymer solubility, coating uniformity, and compatibility with existing electrode manufacturing infrastructure.

• Customer segment: Cell OEMs lead adoption with 62% share, reflecting their direct accountability for battery performance, safety validation, and long-term reliability in automotive applications.

Safety, Regulation, and Cost: Forces Shaping Binder Innovation

Rising scrutiny of battery safety following high-profile thermal runaway incidents has expanded binder performance requirements beyond adhesion and electrochemical stability. Advanced high-nickel binders are increasingly expected to contribute to thermal stability, gas management, and abuse tolerance, particularly in automotive batteries subject to stringent regulatory approval.

At the same time, environmental regulations targeting N-methyl-2-pyrrolidone (NMP) emissions are accelerating research into water-based and low-toxicity binder systems. While aqueous alternatives face technical hurdles in high-nickel applications, regulatory pressure is driving innovation that may reshape processing standards over the next decade.

Cost dynamics also play a central role. Although high-nickel binders carry premium pricing, they can deliver system-level cost benefits by extending battery life, improving safety margins, and enabling higher energy density—critical factors for mass-market EV competitiveness.

Regional Outlook: Where Growth Is Concentrated

The market’s geographic expansion mirrors global battery manufacturing strategies:

• China (CAGR 12.7%) leads growth, supported by large-scale EV production, vertically integrated supply chains, and strong government backing for high-nickel cathode adoption.

• United States (11.3%) benefits from advanced polymer research, domestic battery investments, and incentives aimed at supply chain localization.

• United Kingdom (11.2%) leverages research excellence and academic-industry collaboration to advance binder chemistry innovation.

• Germany (11.1%) draws on chemical manufacturing strength and automotive engineering standards to drive demand for premium binder solutions.

• Japan (10.0%) emphasizes precision manufacturing and quality consistency, sustaining steady adoption of high-performance binders.

Competitive Landscape and Industry Participants

The high-nickel binders market is characterized by intensive R&D competition and close collaboration between material suppliers and battery manufacturers. Key companies profiled include:

• Kureha

• Arkema

• Solvay

• Zeon Corporation

• LG Chem

• Dow, Shin-Etsu Chemical, Wacker Chemie, BASF, JSR Corporation

As high-nickel cathode technologies continue to evolve, binder innovation is expected to remain a decisive factor in determining battery performance, safety, and commercial viability across the global electrification landscape.

Why FMI: https://www.futuremarketinsights.com/why-fmi

Related Reports Insights from Future Market Insights (FMI)

Dolomite Market https://www.futuremarketinsights.com/reports/dolomite-market

Metal Recovery from E-waste Market https://www.futuremarketinsights.com/reports/metal-recovery-from-e-waste-market

Aircraft Contaminant-Resistant Coatings Market https://www.futuremarketinsights.com/reports/aircraft-contaminant-resistant-coatings-market

Precipitated Silica Market https://www.futuremarketinsights.com/reports/precipitated-silica-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Sudip Saha

Future Market Insights Inc.

+ +1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.