Reusable Beverage Bottles and Crates Market is Expected to Surpass USD 2,341.4 Million by 2036 Amid Regulatory Push

Germany’s reusable beverage bottles & crates market grows at a 9.0% CAGR, driven by EU PPWR benchmarks, stable prices, and a strong Pfand deposit culture.

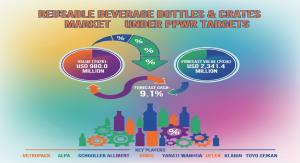

NEWARK, DE, UNITED STATES, February 2, 2026 /EINPresswire.com/ -- The global Reusable Beverage Bottles & Crates Market is entering a decisive growth phase as regulators, beverage producers, and retailers pivot from recycling-led strategies toward mandatory reuse systems. Valued at USD 980.0 million in 2026, the market is projected to reach USD 2,341.4 million by 2036, expanding at a compound annual growth rate (CAGR) of 9.1% over the forecast period.

This growth trajectory is being shaped by the European Union’s Packaging and Packaging Waste Regulation (PPWR), which introduces binding reuse targets for beverages, including a minimum 10% reuse requirement for alcoholic and non-alcoholic drinks by 2030. The regulation is compelling beverage brands and packaging suppliers worldwide to redesign supply chains around durable, refillable packaging formats.

Explore Opportunities – Get Your Sample of Our Industry Overview Now!

https://www.futuremarketinsights.com/reports/sample/rep-gb-31056

What Is Driving the Shift From Recycling to Reuse?

The reusable beverage bottles and crates market encompasses durable glass bottles, refillable PET bottles, and high-density polyethylene (HDPE) crates designed to operate within closed-loop logistics systems. Unlike single-use packaging, these assets are engineered for 25 to 50 refill cycles, enabling measurable reductions in packaging waste and lifecycle emissions.

Key demand drivers include:

• Regulatory enforcement under PPWR, making single-use packaging increasingly costly and non-compliant

• Resurgence of deposit-return schemes (DRS) across Europe and pilot programs in other regions

• Corporate net-zero and circular economy commitments, particularly among multinational beverage producers

• Volatility in virgin PET and glass prices, encouraging asset ownership through reusable fleets

Together, these factors are transforming reusable beverage packaging from a niche sustainability initiative into a core operational requirement.

Market Snapshot: Reusable Beverage Bottles & Crates

Quick Stats (2026–2036)

• Market Value (2026): USD 980.0 million

• Forecast Value (2036): USD 2,341.4 million

• Forecast CAGR: 9.1%

• Leading End-use: Retail refill & deposit systems (40%)

• Leading Material: Glass / rPET (50%)

• Leading Technology: Reverse-logistics + sanitisation (45%)

• Key Growth Countries: India, China, Germany, Brazil, USA, Japan

How Is the Market Structured?

The market is organized around the operational realities of returnable packaging systems:

• By End-use: Retail refill and deposit systems dominate, followed by on-trade venues such as restaurants, bars, and catering services

• By Packaging Format: Primary containers (reusable glass and PET bottles) are supported by secondary transport assets (crates and carriers)

• By Material: Glass and refillable PET coexist, balancing durability, weight, and transport efficiency

• By Technology: Automated washing, inspection, and reverse-logistics infrastructure enable scale and hygiene compliance

Each segment plays a critical role in ensuring that reuse systems can operate at industrial speeds comparable to single-use packaging lines.

Why Retail Refill Systems Are Shaping Bottle Design

Retail refill and deposit systems account for the largest share of market revenue, driven by established infrastructure in Central Europe and expanding pilot programs globally. To perform reliably in these systems, reusable bottles are engineered with:

• Thicker walls and reinforced bases

• Scuff-resistant surface coatings

• Compatibility with reverse vending machines (RVMs)

These design specifications deliver the lowest environmental impact per liter consumed across the packaging lifecycle, making them the preferred choice under PPWR compliance strategies.

Material Innovation: Balancing Weight and Durability

Glass and refillable PET (rPET) remain the dominant material combination:

• Glass is favored for beer and premium beverages due to its chemical inertness and brand perception

• Refillable PET is gaining share in soft drinks and water, supported by lower transport emissions

Manufacturers are advancing PET blends with enhanced thermal stability, enabling bottles to withstand hot caustic washing without deformation. This dual-material approach allows reuse systems to scale across diverse beverage categories.

How Reverse Logistics Technology Enables Economic Viability

The success of reuse models depends on efficiently returning empty containers to fillers. As a result, reverse-logistics and sanitisation technologies represent the leading innovation stream in the market.

Key developments include:

• Automated crate washing and bottle inspection using optical sensors

• High-speed systems that match single-use filling line throughput

• Centralized washing hubs located near retail clusters to reduce transport emissions

These technologies underpin consumer safety, regulatory compliance, and cost competitiveness.

Universal “Pool Bottles” and the Push for Standardization

A defining trend is the adoption of standardized pool bottles, where multiple brands share a common bottle design that can be refilled by any local bottler. This approach:

• Reduces sorting and transport distances

• Lowers reverse-logistics costs

• Decreases the carbon footprint of reuse systems

Pooling is increasingly supported by industry consortia, positioning reusable bottles and crates as shared infrastructure assets rather than brand-specific packaging.

Regional Growth Outlook: Diverging but Accelerating

Growth patterns vary by region:

• India (CAGR 12.0%): Expansion driven by modernization of food and beverage supply chains and organized logistics

• China (10.5%): Strong on-trade demand supported by rising catering revenue

• Germany (9.0%): A mature benchmark market optimizing high-rotation refill systems

• Brazil (8.0%): Tourism and dining activity sustaining returnable glass formats

• United States (7.2%): Large beverage shipment volumes creating circularity potential

• Japan (5.0%): Efficiency-driven adoption of standardized crates and ultra-durable bottles

Competitive Landscape: Integration Over Volume

Competition in the reusable beverage bottles and crates market is increasingly defined by system integration rather than unit sales. Leading players are expanding beyond manufacturing into:

• Pooling and asset management services

• Smart tracking technologies using RFID and Bluetooth

• Investments in regional washing and logistics hubs

Key market participants include Vetropack, ALPLA, Schoeller Allibert, Orbis, Plastipak, Yantai Wanhua, UFlex, Klabin, and Toyo Seikan.

Why FMI: https://www.futuremarketinsights.com/why-fmi

Have a Look at Related Research Reports on the Packaging Domain:

Tool Box Market https://www.futuremarketinsights.com/reports/tool-boxes-market

Paper Bags Market https://www.futuremarketinsights.com/reports/paper-bags-market

Transport Cases and Boxes Market https://www.futuremarketinsights.com/reports/transport-cases-and-boxes-market

PCR Cosmetic Packaging Market https://www.futuremarketinsights.com/reports/pcr-cosmetic-packaging-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.